Bill Pay

- Online banking requires you to use an email account.

- Protect access to this account at all times because it is used for communication from online banking.

- If you elect to use online banking, you can then register for bill pay.

- Once you register for bill pay, payees can be established.

- Recipients receive the money in one of two ways depending on the recipient’s capability:

- Paper check

- Money is withdrawn when check is cashed.

- Electronic ACH

- These funds are immediately transferred on the scheduled day.

- Paper check

- Recipients receive the money in one of two ways depending on the recipient’s capability:

- For support call the bank

What are the risks of using bill pay?

- If you do not protect your computer or device in the manner described, a hacker could take over your machine.

- After taking over your machine, they could watch you login into online banking.

- After learning your online banking credentials, they could add themselves as a payee in online banking and pay money out of your account into theirs.

Ways to protect yourself

- Log into your account regularly and check your balances, activities, and payees.

- Secure your device as described previously.

- Monitor your emails diligently for notifications of changes to your online account and payees.

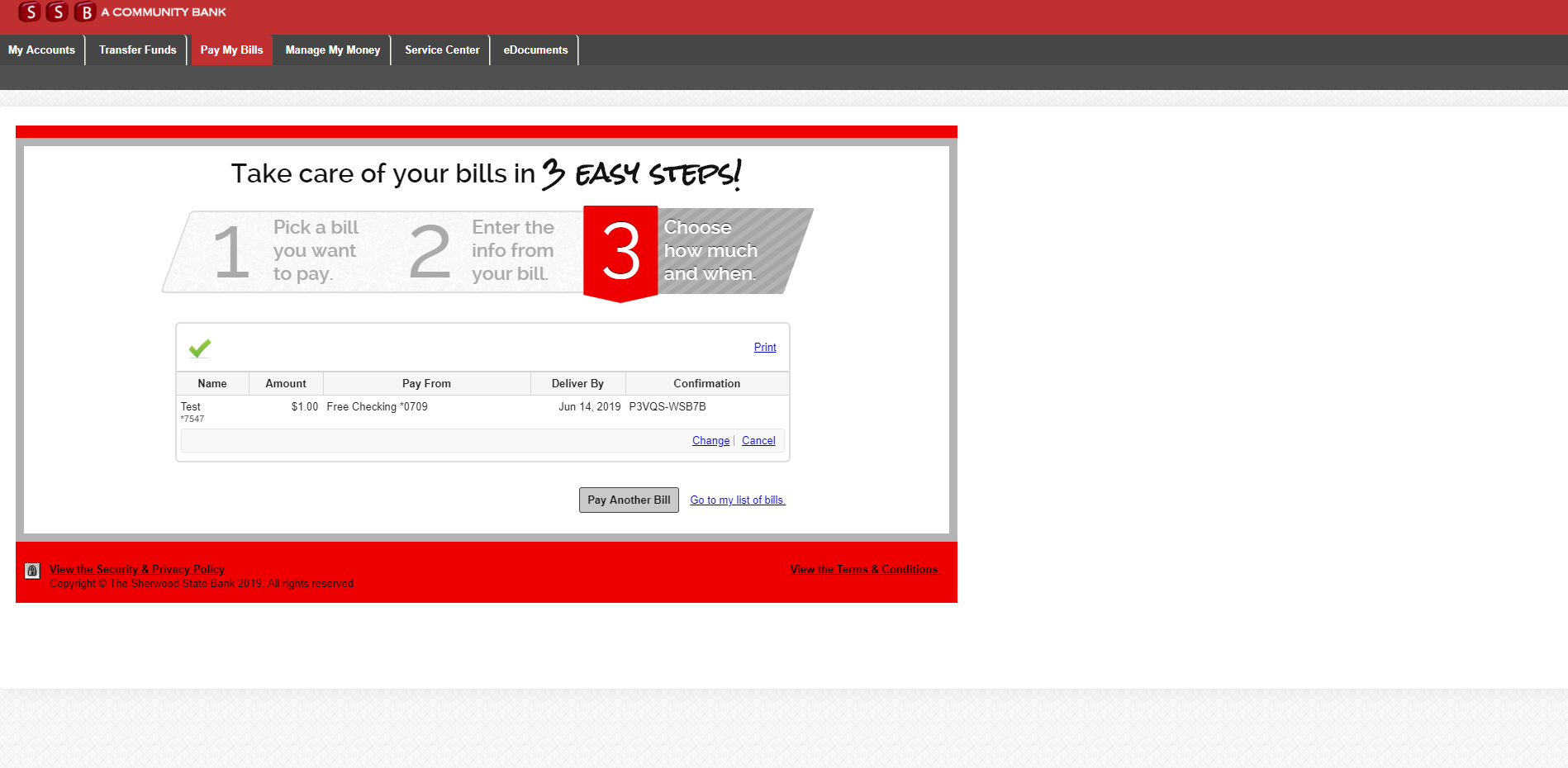

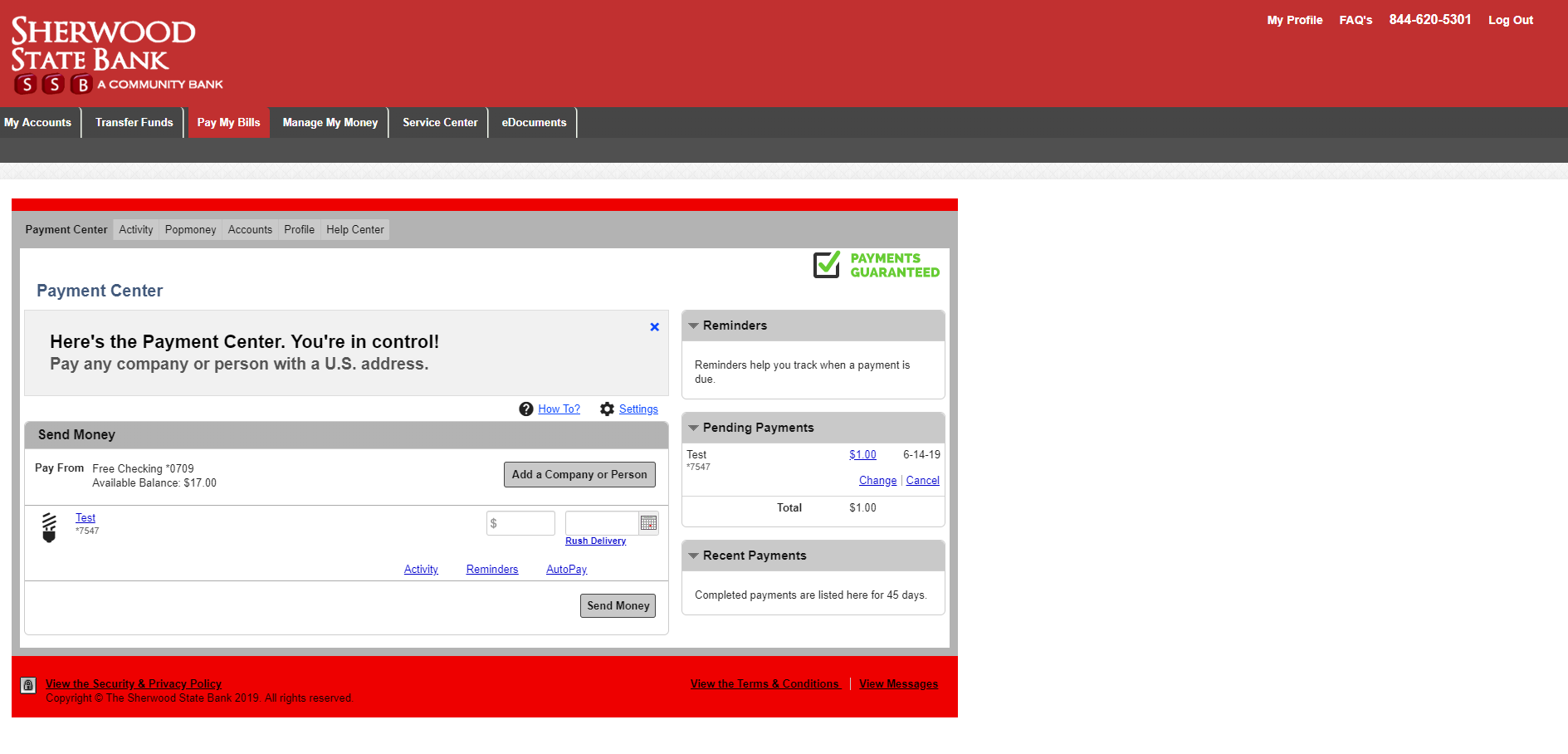

Bill Pay Screenshot

Your bill pay screen is in online banking should look like the image below. If it does not or if you have any doubt, contact the bank.